One of the biggest differences when considering a USDA mortgage and an enthusiastic FHA financing is the downpayment requisite. Basically, you can buy an effective USDA loan instead and work out a down payment.

To acquire an FHA mortgage, you need to lay out no less than 3.5% of one’s purchase price. All round deposit importance of FHA fund ranges out of step 3.5% to help you ten%. You might establish so much more, nevertheless the common recommendation is to try to envision a separate home loan, particularly a traditional mortgage, whenever you can pay for a bigger advance payment. The expense of a keen FHA loan’s mortgage insurance policies helps it be costly than other alternatives for individuals that will create huge down repayments.

2. Location Standards

Other renowned difference in the brand new FHA and you may USDA financing applications are the spot restrictions new USDA financing program enjoys. If you wish to purchase a property that have a keen FHA mortgage, you can get property around the world. You can get a four-device place in the heart of new York Urban area otherwise a good sprawling ranch in the center of Montana.

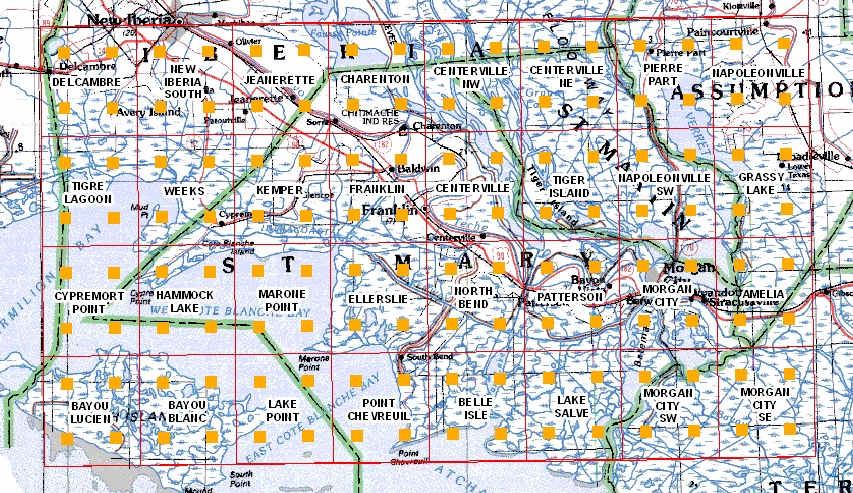

That is not the way it is which have a great USDA mortgage. The house or property you get with a USDA loan must be situated in a qualified city. Eligible components include outlying places, also certain residential district section. You might be astonished at what truly matters due to the fact rural in USDA’s meaning, so unless you want it a property from inside the an urban city, it could be worthwhile to evaluate brand new USDA’s qualifications map so you can find out if your location qualifies.

step 3. Credit rating Eligibility

Your credit rating plays a role in this payday loan Five Points new acceptance techniques when you want to score home financing purchasing a property. But, regarding an FHA or USDA mortgage, it may enjoy less of a member than it can if you used to be obtaining a normal mortgage.

Both mortgage software have more lenient borrowing standards than other financial programs. The fresh new USDA mortgage system doesn’t have lay credit conditions. That said, the lender your work at possess its very own set of standards getting consumers who want to get good USDA financing. Have a tendency to, a credit rating over 640 is advised for folks who was wanting a good USDA mortgage.

The financing conditions to possess an FHA financing dictate how big is the latest advance payment you could make. In the event the rating try lower than 580 but more than 500, you could potentially be eligible for an enthusiastic FHA mortgage but need to lay off 10%. If for example the score is more than 580, you could put down as little as step 3.5%.

cuatro. Home loan Insurance rates Requirements

Home loan insurance policy is the main offer if or not your sign up for a keen FHA or a good USDA loan. However the amount of the mortgage insurance premiums will vary most according to system you select.

FHA fund has high mortgage insurance costs than simply USDA fund, especially if you generate an inferior down-payment. For individuals who put down the minimum 3.5%, your own monthly home loan advanced could be 0.85% of loan amount. You need to pay new advanced for the entire label out-of the loan. The month-to-month advanced is within introduction for the 1.75% you repaid upfront.

The necessary superior, or money percentage, for a beneficial USDA financing are not more than 0.5% of your own leftover harmony and you can 3.75% initial. You pay the newest monthly superior through the title of one’s USDA loan.

5. Settlement costs

Having each other a beneficial USDA and you may a keen FHA financing, the newest debtor is responsible for paying closing costs. But exactly how new closing costs try managed can differ. Which have an excellent USDA loan, you could potentially acquire more than the worth of the house and you can fool around with a number of the more funds to pay for settlement costs. Which is not often an alternative having a keen FHA financing. Investment some otherwise all settlement costs helps make purchasing a house economical.