Property syndicates get a detrimental term since there try particular tricky stuff going on, I believe back into the 90’s otherwise early 2000’s in which some one had shagged more. So just make sure that you do your pursuit on the the syndicate that you’re committing to before you go in the future and you will buy they. If you prefer greater detail about what a home syndicate are see and it will reroute you to an article one I’ve currently done regarding the assets syndicate.

This new seventh system is assets selection and this refers to an incredibly tricky question and another I am not saying probably go into inside the higher outline. If you would like see that it in detail head to rickotton, an Australian guy who spends this way in which he try very profitable from the they. So if one music complicated to you then it’s probably not an informed technique for your, however if choices seem sensible to you, next probably you could just go and you might pick a keen solution towards possessions of course, if you to property up coming increases during the worth, then you may be able to choose the possessions at the rate set in your option and have an entire funds getting they because it is really worth a lot more.

Once again, this is not something I’m suggesting since it is extremely high-risk for you to definitely high-quantity of interest in order to have got all ones fund

Today, it is going getting challenging that have funds since the banking institutions wish get on the fresh new safer top so that you are going to need to seriously work out how this is accomplished before you go to come and take action. It is however a chance, when you ask somebody who is quite [inaudible 9:27], prepared to go out and cause people to offers to enjoys an enthusiastic choice on that assets then this can be something could do the job.

Most lenders at present actually want to see 5% discounts prior to they might be happy to lend your any money. Thus for the majority circumstances this isn’t planning to functions, but i have been aware of those who had unsecured personal loans to assist them to for the shortage anywhere between their put as well as the possessions that they are interested in.

Brand new ninth means which i is to checklist is you can in fact score something special from a member of family and buy a possessions this way. So that they provide the put and also you probably you would like a statutory statement or stat dec going and one to. However they current you the currency and you will up coming have fun with that cash to buy property. Of many moms and dads do this and their students and that will render her or him money to get into the property sector and therefore is actually a very common situation that you may possibly perform. Get something special and rehearse that to purchase a property. If you have large moms and dads that way, a great you, I wish all to you an educated.

Brand new 7 strategy that i i do not want to explore but have read about they regarding the discussion boards is that you can probably rating unsecured signature loans to greatly help finance their deposit

You to definitely closes of for my situation now with the ways that you can purchase a house in place of a deposit. Its more difficult accomplish, especially here in Australia to invest in property versus in initial deposit. But not, it is still you’ll be able to so that you don’t need to stop.

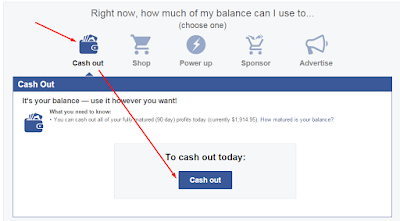

If you’d like to access my personal list to greatly help you know how most of a deposit you need to save yourself and have your on the road to rescuing your deposit go for your requirements can be go into your current email address and have now entry to one to totally free.